The resilience of low income Indonesians and their ability to scratch out a living from very meagre resources never ceases to amaze economists and financial observers. Yet for many the resultant lifestyle is one that remains trapped in abject poverty. For those in rural parts of Indonesia the choices for work are often limited to a handful of options. Growing rice or some other crop is common, but requires land. Raising livestock can use less land, but requires animal skills and involves constantly checking to make sure that the livestock are in good health. In almost all examples, there is a genuine need to find extra work options by layering additional structures alongside the existing work.

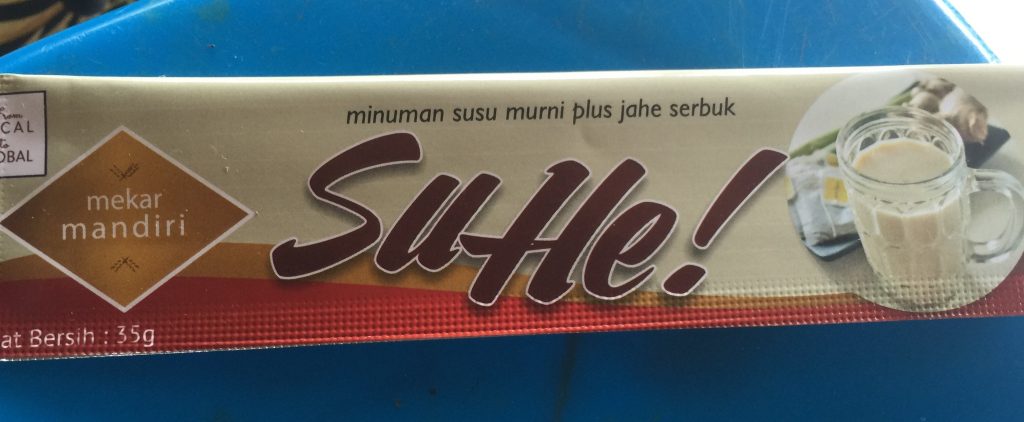

Such is the case of Ayesha from a village in the area of Subang north of Bandung. Whilst her husband looks after half a dozen cows in a very small dairy, Ayesha leverages the supply of milk from their micro-dairy to allow her to develop a ginger flavoured, powdered milk drink called “Suhe” (pronounced Soo-hay). The drink is delicious and comes in sachet form for easy distribution, and for marketing appeal to young children. To produce her new product, Ayesha relies on milk from the dairy, and a set of kitchen utensils that she uses to turn the leftover dairy product into powdered milk.

The advantage for a husband and wife team whose primary product is wholesale milk, is that Ayesha’s additional powdered drink venture also provides much-needed income to help support their needs when demand and supply of milk is volatile. Before creating powdered milk drink products, Ayesha’s and her husband were very vulnerable to the ups and downs of a small dairy. If one cow got sick, the added strain onto the other 5 cows was difficult. In short, the extra income from Suhe can provide stability for a young couple, and at the same time provides a pathway for the family to rise above the trap of financial insecurity.

Located at the foot of the Tangkuban Perahu volcano, Ayesha’s and her husband are keen to expand into new enterprises that can help the long-term practicability for Ayesha and her family. Yet many Indonesians make the mistake of placing all their eggs into the one basket. Previously Ayesha and her husband simply kept cows in the dairy, where the risk of disease and misfortune had a regular likelihood of occurring. Such a dependence had high level consequences since the production of milk had become their sole source of income. In 2016 Ayesha and her family have greater security, and better prospects. Her Suhe ginger milk product is gaining acceptance in the north of Bandung, and there are plans to offer additional flavour options in the future.

There is an important lesson for struggling Indonesians who work in informal and variable situations trying to make a living of one sort or another. Indonesians can become trapped into impossible situations where debts can spiral out of control and where the man of the house cannot feed his family because there is not enough money to distribute. For many, the idea of working with livestock and crops means subsisting from day to day, and hoping for something to change. There are many Indonesians who find it impossible to rise out of poverty. Some become trapped in debt, and are unable to earn additional income. They become trapped in a cycle of lowly paid work, and find themselves unable to break free from their circumstances.

One of the most effective methods of breaking the cycle of poverty is to show agility and flexibility in adapting to new opportunities and new systems, and to encourage folk to broaden their horizons. This is where micro-finance organisations like the Australian NGO Bamboo Micro Credit provide highly advantageous opportunities to assist Indonesians to rise out of poverty. For those who live in poverty, micro loans might sound like risky business. But the risk is not so much about a loan default, as it is about preventing the collapse of the family unit, and providing an interest-free, debt-reducing option to help Indonesians to break free of the financial grip of poverty. Bamboo Micro Credit provides micro-finance 365 days of the year. They operate in both Sumatra and Java, and are looking to carefully expand their services through other parts of the Indonesian Archipelago.

Bamboo Micro Credit. It’s not a hand out… it’s a hand up.

About the Author

David Cook is an Indonesianist, a technologist and an academic interested in poverty, social justice, CSR and Human Computer Interaction. He is a Director of Bamboo Micro Credit.